nh meals tax payment

The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations. Rev 70207 Meals Furnished by an Operator to Employees.

Everywhere Kids Eat Free In Nh Kids Eat Free Eat Free Children Eating

Gallen State Office Park Johnson Hall 107 Pleasant Street Concord NH 03301-3834 6032712578 TDD Access.

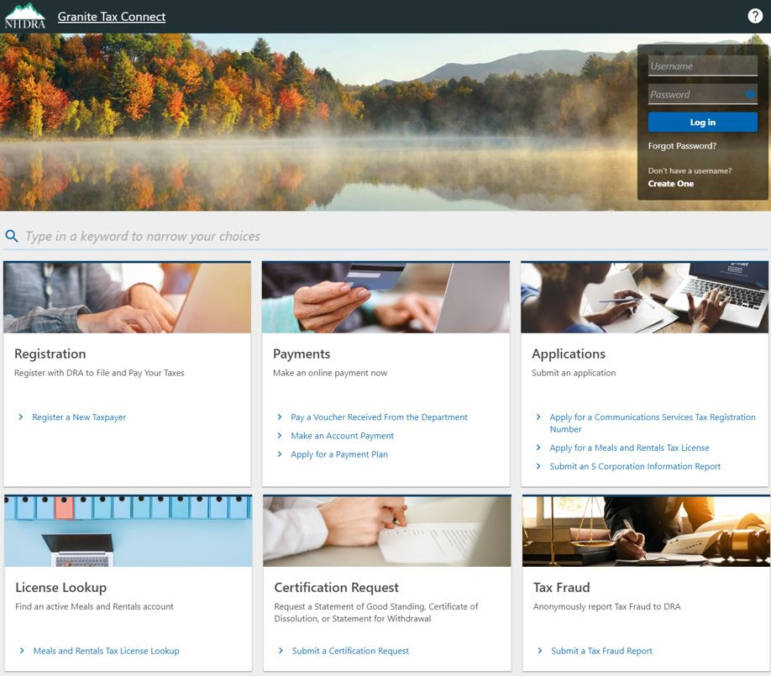

. Click on the link to access your existing account or to create a new account today. The states meals and rooms tax will drop from 9 to 85. Meals and Rooms Operators.

New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. NH Meals Tax Policy. The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more.

Chapter 144 Laws of 2009 increased the rate from 8 to the current rate. Filing options - Granite Tax Connect. If I dont collect this tax I can be forced to pay the tax penalized and put into other legal jeopardy.

Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85 TIR 2021-004 2021 Legislative Session in Review September 7 2021. Meals and Rooms Tax Where The Money Comers From TransparentNH. This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as of January 1 2022.

A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. A 9 tax is also assessed on motor vehicle rentals.

Meals furnished by an operator to its employee for which the employee is required to pay a charge either by the cost being withheld from the employee s wages or by actual payment shall be subject to tax based on the amount deducted or paid by the employee. The budget also assumes the exclusion of forgiven amounts on federal loans received via. Find Out Today If You Qualify.

Clerkbtlanhgov Directions to BTLA. Please mail TAX PAYMENTS ONLY to the following address. There will be a 9 NH Meals Tax applied to all food beverage and will be shown on your invoice.

The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. Payment for all DRA tax types should be made through the Departments online portal GRANITE TAX CONNECT. Filing options - Granite Tax Connect.

Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the customer receipt or check. There is no blanket NH Meals Tax exemption for non-profit organizations. Portable Document Format pdf.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. 603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. Relay NH 1-800-735-2964 email.

Use the link on the left side of page Payment Options to make a payment on-line by credit card or e. Visit nhgov for a list of free pdf readers for a variety of operating systems. 603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301.

There are limited exemptions for instrumentalities of the state of NH the federal government schools and medical facilities that directly involve an educational purpose. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax. Meals and Rentals TaxRSA Chapter 78-A.

A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. The employer must also.

For additional assistance please call the Department of Revenue Administration at 603 230-5920. The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5. This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as.

E-file fees do not apply to NY state returns. Under New Hampshire State law I am now obligated to collect the 9 Meals Rooms MR tax for the NH Revenue Administration. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT.

Multiply this amount by 09 9 and enter the result on Line 2. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. Yes employers must provide in writing an employees rate of pay at the time of.

Dining Nh Collection Barcelona Podium

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

Turkish Kebab S Subs And Grill The Second Lunch

Dining Nh Collection Copenhagen

New Hampshire Income Tax Calculator Smartasset

Pin By Bellshomestead On Planning Our Homestead Prepared Foods Food Protection Lemon Balm

We All Scream For Ice Cream Open For Business Baileysbubble Nhfineproperties Baileysbubble Wolfeboronh Lakesregion Lake Winnipesaukee Outdoor Decor Decor

Nothin Like A Coffee Break In Meredith Nh Nhfineproperties Meredithnh Lakewinnipesauke Nhrealtor Coffeebreak Millsfalls Meredith Nh Travel Fair Grounds

Local Eatery The Lakes Region S Farm To Table Restaurant Local Eatery Restaurant Offers Restaurant

New Hampshire Meals And Rooms Tax Rate Cut Begins

Boston Area Leather Furniture Tax Free Nh Currier S American Leather Sleeper Sofa American Leather Leather Furniture

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Cheap Lobster Prices At Markey S In Seabrook N H York Beach New England Cheap Travel Blog Cheap Travel York Beach Seabrook

Nh Dept Of Revenue Administration Launches New Online User Portal For Paying Taxes And More Manchester Ink Link

Sights And Flavors Of Tokyo Tokyo Tour Tokyo Gotemba

The Chinese Food In New Hampshire Actually Comes From A Small Town Gas Station