capital gains tax canada exemption

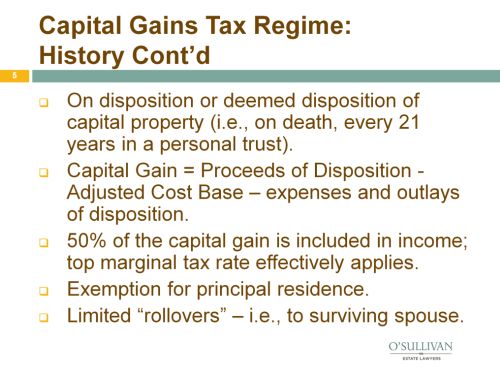

Dispositions of qualified small business corporation shares. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return.

:format(webp)/https://www.thestar.com/content/dam/thestar/business/opinion/2022/02/26/the-50-per-cent-inclusion-rate-on-capital-gains-benefits-mostly-the-rich-its-time-to-bump-it-up/capital_gains_tax.jpg)

The 50 Per Cent Inclusion Rate On Capital Gains Benefits Mostly The Rich It S Time To Bump It Up The Star

Estimates of Economic Losses.

. Transferring the ownership of an investment to a family member counts as disposition of that investment and so the gift becomes subject to capital gains tax. Gains realized on dispositions of principal residences and property owned for personal use would generally be exempt subject to some limits. Lifetime capital gains exemption limit.

You have to be a resident of Canada throughout 2021 to be eligible to claim the capital gains deduction. To maximize the 750000 Canadian capital gains exemption from Canadian income tax on sale of qualifying small business shares QSBC available to every individual consider having your. For 2021 if you disposed of qualified small business corporation shares QSBCS.

Is there a one-time capital gains exemption in Canada. The capital gains exemption is cumulative and. One of the more generous aspects of Canadian taxation is the Lifetime Capital Gains Exemption LCGE.

If your capital gains are 100000 you will be subject to a capital gains tax on 50000. For the 2020 tax year if you sold Qualified Small Business Corporation. Non-taxpayers pay Capital Gains Tax at 18 assuming that the gain is greater than the annual Capital Gains Tax exempt amount of 11000 for individuals in the 2014-15 tax.

Its not for personal capital gain. The term capital gains exemption refers to a benefit provided by the government to taxpayers that relieves them of the requirement to pay capital gains tax. When each child claims their capital gains exemption of 750000 they would therefore be liable to pay taxes on only.

Tax - 1276 Corporate income tax - 678 Capital gains tax - 439 Net -. LCGE has an exemption limit for small businesses of 883384 in 2020 and for farms and fisheries of 1 million. So if there were three offspring each would receive 1 million.

This amount is indexed to inflation. The capital gains deduction can be applied against taxable capital gains included in 2021 income that arose from. If at any time during the period you owned the property it was not your.

After considerable debate on. The tax rate differs for property held for less than a year short-term capital gains tax which is taxed at a higher rate than the gain on the property held for more than a year. For the purposes of this deduction the CRA will also consider you to.

If the property was solely your principal residence for every year you owned it you do not have to pay tax on the gain. This exemption also applies to reserves from these properties brought into income in a tax year. The inclusion rate for capital gains is currently 50 meaning the taxable portion of an exempt gain is 456815.

The lifetime capital gains exemption in Canada is designed to allow individuals to dispose of certain types of business assets without having to pay tax on a percentage of their capital. For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased. The inclusion rate for personal.

Mar 01 2022 Under current law households can exempt from their capital gains taxes the first 250000 Single500000 Married of profits from the sale of a primary residence. This is the amount that we are talking about if the gains exemption. The German capital gains tax The total fiscal loss of a wealth Example.

Lifetime Capital Gains Exemption LCGE LCGE is claimed against the income included under Capital gains from the eligible property by an eligible taxpayer.

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Kalfa Law Capital Gains Exemption 2020 Capital Gains Tax

International Tax Treaty Canada Freeman Law Jdsupra

Short Term And Long Term Capital Gains Tax Rates By Income

Canadian Principal Residence Capital Gains Exemption Under Threat

Short Term And Long Term Capital Gains Tax Rates By Income

Mechanics Of The 0 Long Term Capital Gains Rate

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

Farmers And The Alternative Minimum Tax Baker Tilly Canada Chartered Professional Accountants

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

New Tax Rules For Canadian Controlled Private Corporations Madan Ca

Understanding The Lifetime Capital Gains Exemption And Its Benefits Davis Martindale Blog

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Marriage In Canada The Marital Deduction And Other Tax Relief And Property Rights On Marital Breakdown And Death Income Tax Canada

Capital Gains Tax Rate Rules In Canada What You Need To Know

Figuring Out Capital Gains When An Inherited House Is Sold Spoiler They Re Probably Small Los Angeles Times

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)